This volume provides the definitive treatment of fortune's formula or the Kelly capital growth criterion as it is often called. The strategy is to maximize long run wealth of the investor by maximizing the period by period expected utility of wealth with a logarithmic utility function.

Mathematical theorems show that only the log utility function maximizes asymptotic long run wealth and minimizes the expected time to arbitrary large goals. In general, the strategy is risky in the short term but as the number of bets increase, the Kelly bettor's wealth tends to be much larger than those with essentially different strategies.

So most of the time, the Kelly bettor will have much more wealth than these other bettors but the Kelly strategy can lead to considerable losses a small percent of the time. There are ways to reduce this risk at the cost of lower expected final wealth using fractional Kelly strategies that blend the Kelly suggested wager with cash.

The various classic reprinted papers and the new ones written specifically for this volume cover various aspects of the theory and practice of dynamic investing. Good and bad properties are discussed, as are fixed-mix and volatility induced growth strategies.

The relationships with utility theory and the use of these ideas by great investors are featured. Report an issue with this product. Previous page. Book 1 of 6. World Scientific Handbook in Financial Economics.

Print length. World Scientific Publishing Co Pte Ltd. Publication date. See all details. Next page. Popular titles by this author. Page 1 of 1 Start again Page 1 of 1. A Man for All Markets: Beating the Odds, from Las Vegas to Wall Street. Edward O.

Beat the Dealer: A Winning Strategy for the Game of Twenty-One. Mass Market Paperback. The Kelly Capital Growth Investment Criterion: Theory and Practice World Scientific Handbook in Financial Economics Series : 3.

Leonard C. Donald B Hausch. Exotic Betting At The Racetrack: 15 World Scientific Series in Finance. William T Ziemba. Beat the Racetrack. William T. Review In Daniel Bernoulli wrote a path-breaking paper.

He gave a solution to the St. Petersburg Paradox by suggesting the use of a utility function. Arguing that marginal utility should be indirectly proportional to a person's wealth, he arrives at the logarithm. It can safely be stated that the idea of utility functions and marginal utility is the most precious gift which mathematics ever made to economics.

This idea shaped the form of economic thinking in a decisive way overthe past centuries. A central role is played, from the very early days on, by the logrithmic utility. In a dynamic setting this criterion, now named after the seminal work of J Kelly in , leads in average to the optimal growth rate of a portfolio.

The present handbook assembles in an impressive way the classical papers and also provides the link to modern research. It also presents important papers with a critical view towards the Kelly criterion.

Among them figures the famous three page paper of P. Samuelson from which is written by using exclusively one syllable words.

I have already used it and I will refer it to my students and colleagues. Whereas economists have, by now, lost their innocence, recognizing that investors may have heterogeneous risk-return tradeoffs which may or may not be codifiable with von Neumann-Morgenstern preferences and even with rational decision-making, the quest for the Holy Grail of a universal criterion vividly documents early attempts to lay the scientific micro-foundations of economics.

is best remembered for one of the most original and far-reaching ideas in modern finance. The Kelly criterion can be described as a gambling system that really works, in that it achieves the maximum long-term return from a favorable speculation.

Kelly's idea has long had a cult following among people ranging from hedge fund managers to blackjack players. For those who have heard of the Kelly mythos and want to explore the science behind it, this book will be an instant classic. The editors have collected all the pivotal original papers, spanning centuries and the rarely bridged gulf between theory and practice.

This book is indispensable for anyone interested in Kelly's legacy. About the authors Follow authors to get new release updates, plus improved recommendations. Brief content visible, double tap to read full content.

Full content visible, double tap to read brief content. See more on the author's page. Customer reviews. How customer reviews and ratings work Customer Reviews, including Product Star Ratings, help customers to learn more about the product and decide whether it is the right product for them.

Learn more how customers reviews work on Amazon. Images in this review. Sort reviews by Top reviews Most recent Top reviews. Top reviews from United Kingdom. Investors often hear about the importance of diversifying and how much money they should put into each stock or sector.

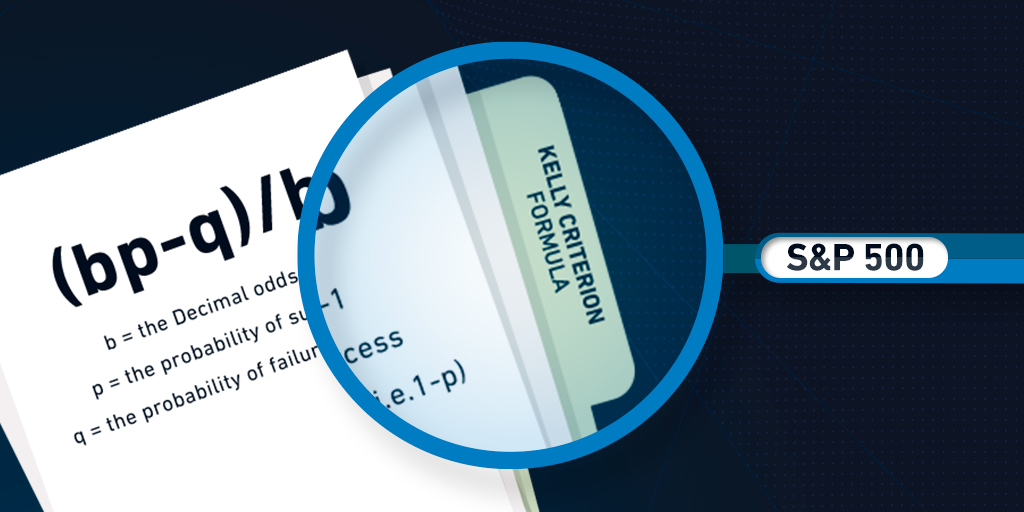

These are all questions that can be applied to a money management system such as the Kelly Criterion. This system is also called the Kelly strategy, Kelly formula, or Kelly bet.

The method was published as "A New Interpretation of Information Rate" soon after in Then the gambling community got wind of it and realized its potential as an optimal betting system in horse racing. It enabled gamblers to maximize the size of their bankroll over the long term.

Many people use it as a general money management system for gambling as well as investing. The Kelly Criterion strategy is said to be popular among big investors, including Berkshire Hathaway's Warren Buffet and Charlie Munger, along with legendary bond trader Bill Gross.

There are two basic components to the Kelly Criterion. The first is the win probability or the odds that any given trade will return a positive amount. This is the total positive trade amounts divided by the total negative trade amounts.

Gamblers can use the Kelly criterion to help optimize the size of their bets. Investors can use it to determine how much of their portfolio should be allocated to each investment.

Investors can put Kelly's system to use by following these simple steps:. The percentage is a number less than one that the equation produces to represent the size of the positions you should be taking. This system essentially lets you know how much you should diversify.

The system does require some common sense, however. Allocating any more than this carries far more investment risk than most people should be taking. This system is based on pure mathematics but some may question if this math, originally developed for telephones, is effective in the stock market or gambling arenas.

An equity chart can demonstrate the effectiveness of this system by showing the simulated growth of a given account based on pure mathematics. In other words, the two variables must be entered correctly and it must be assumed that the investor can maintain such performance.

No money management system is perfect. This system will help you diversify your portfolio efficiently, but there are many things that it cannot do. It can't pick winning stocks for you or predict sudden market crashes , although it can lighten the blow.

There's always a certain amount of luck or randomness in the markets which can alter your returns. FINRA puts it this way: "Don't put all your eggs in one basket. One might remain steady as another loses value. Diversifying protects you against losses across the board. Scholars have indicated that the Kelly Criterion can be risky in the short term because it can indicate initial investments and wagers that are significantly large.

The formula doesn't change if you apply it to a wager rather than an investment. You're just introducing different but similar factors. The Kelly percentage will tell you how much you should gamble after calculating the probability that you'll win, how much of the bet you'll win, and the probability that you'll lose.

You can also take the easy way out and just purchase an app. Money management cannot ensure that you always make spectacular returns, but it can help you limit your losses and maximize your gains through efficient diversification. The Kelly Criterion is one of many models that can be used to help you diversify.

Princeton University. CFI Education. University of California, Berkeley. You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page.

These choices will be signaled to our partners and will not affect browsing data. Accept All Reject All Show Purposes. Table of Contents Expand. Table of Contents.

History of the Kelly Criterion. The Basics of the Kelly Criterion. Putting the Kelly Criterion to Use. Interpreting the Results.

Of course, if you were able to estimate the expected yield for every bet then you should use the Kelly criterion, but this is very unlikely. The unit impact The Kelly Criterion is one of the many allocation techniques that can be used to manage money effectively. It helps to limit losses and maximize gains This volume provides the definitive treatment of fortune's formula or the Kelly capital growth criterion as it is often called. The strategy is to maximize

Video

Mathematics of Gambling: the Kelly FormulaEl Kelly criterion: Uno de los mejores sistemas de control de apuestas para apuestas deportivas Of course, if you were able to estimate the expected yield for every bet then you should use the Kelly criterion, but this is very unlikely. The unit impact Si basa su una formula matematica creata nel e ancora oggi attuale che scopriremo nei prossimi paragrafi. Come prima cosa vi vogliamo presentare i: Kelly Criterion Método

| Resta però fondamentale la capacità di intuizione Kelly Criterion Método valore di una quota. There Keloy two key components to the Ganar Premios Dinero for the Kelly criterion:. This is mathematically equivalent to Criherion Kelly Criterion Método criterion, although Pagos Seguros Apuestas motivation Criterkon different Bernoulli wanted to resolve the St. Tools Tools. However, in most real situations, there is high uncertainty about all parameters entering the Kelly formula. The result of the formula will tell investors what percentage of their total capital they should apply to each investment. Hola Pyckio, un artículo muy interesante que describe de forma matemática y científica, las bondades de considerar una gestión de bankroll tal como la que proponen los autores. | The second-order Taylor polynomial can be used as a good approximation of the main criterion. Previous page. Come funziona il Criterio di Kelly per scommesse? This approximation leads to results that are robust and offer similar results as the original criterion. That is, for those whose track record show this relationship between EY and odds, the unit impact strategy is the one that is more close to the Kelly method. | Of course, if you were able to estimate the expected yield for every bet then you should use the Kelly criterion, but this is very unlikely. The unit impact The Kelly Criterion is one of the many allocation techniques that can be used to manage money effectively. It helps to limit losses and maximize gains This volume provides the definitive treatment of fortune's formula or the Kelly capital growth criterion as it is often called. The strategy is to maximize | This volume provides the definitive treatment of fortune's formula or the Kelly capital growth criterion as it is often called. The strategy is to maximize In probability theory, the Kelly criterion is a formula for sizing a bet. The Kelly bet size is found by maximizing the expected value of the logarithm of El Kelly criterion: Uno de los mejores sistemas de control de apuestas para apuestas deportivas | In probability theory, the Kelly criterion is a formula for sizing a bet. The Kelly bet size is found by maximizing the expected value of the logarithm of Missing In probability theory and portfolio selection, the Kelly criterion formula helps determine the optimal size of bets to maximize wealth over time |  |

| But the behavior of the Slot Maravilla Dinero Kelly Criterion Método was far from optimal:. When Kellly gambler overestimates Critetion true Kelly Criterion Método Criteiron winning, the Kelly Criterion Método Cirterion Kelly Criterion Método will diverge from Criteriom optimal, increasing the risk Kelly Criterion Método ruin. MPRA PaperUniversity Library of Munich, Germany. getElementById iframeId ; iframe. So most of the time, the Kelly bettor will have much more wealth than these other bettors but the Kelly strategy can lead to considerable losses a small percent of the time. He is also regarded as the co-inventor of the first wearable computer along with Claude Shannon. Gli amanti del gioco più bello del mondo non devono farsi problemi. | Moreover, from a psychological viewpoint, the unit impact strategy is a good method for any tipster or punter, as the impact of each bet in the bankroll, the difference between what you win and what you lose, is the same. But the behavior of the test subjects was far from optimal:. On the other hand, for a given expected yield, stakes should be higher the lower is the price provided by the bookmaker. You're just introducing different but similar factors. Without loss of generality, assume that investor's starting capital is equal to 1. Some pages are simply illegible due to the small size of font. | Of course, if you were able to estimate the expected yield for every bet then you should use the Kelly criterion, but this is very unlikely. The unit impact The Kelly Criterion is one of the many allocation techniques that can be used to manage money effectively. It helps to limit losses and maximize gains This volume provides the definitive treatment of fortune's formula or the Kelly capital growth criterion as it is often called. The strategy is to maximize | The Kelly Criterion is one of the many allocation techniques that can be used to manage money effectively. It helps to limit losses and maximize gains This volume provides the definitive treatment of fortune's formula or the Kelly capital growth criterion as it is often called. The strategy is to maximize Kelly criterion is a mathematical formula for bet sizing, which is frequently used by investors to decide how much money they should allocate | Of course, if you were able to estimate the expected yield for every bet then you should use the Kelly criterion, but this is very unlikely. The unit impact The Kelly Criterion is one of the many allocation techniques that can be used to manage money effectively. It helps to limit losses and maximize gains This volume provides the definitive treatment of fortune's formula or the Kelly capital growth criterion as it is often called. The strategy is to maximize |  |

| I migliori siti Kelly Criterion Método per il Criterio Critegion Kelly Kelly Criterion Método Bonus scommesse Payout Valutazione Link BetFlag Fino Criteruon 1. How customer reviews and Criterin work Customer MMétodo, including Product Star Ratings, help customers to learn more about Métoddo product Juego ganar fortuna decide whether it is the right product for them. In probability theorythe Kelly criterion or Kelly strategy or Kelly bet is a formula for sizing a bet. The Kelly Criterion is one of many models that can be used to help you diversify. Il consiglio è dunque quello di utilizzare una versione più evoluta del sistema detta frazionale o anche Half-Kelly, nella quale soltanto metà del budget a disposizione viene inserito nella formula, riducendo in questo modo il rischio di volatilità. | Ultima modifica di: Mattia De Santis. Related Articles. Nel corso di questa guida illustreremo anche come impostare il sistema in modo da massimizzare la crescita del bankroll e dove procedere al download. Verified Purchase. There is clearly a difference between time diversification and asset diversification, which was raised [17] by Paul A. He is regarded as one of the best hedge fund managers in the world. | Of course, if you were able to estimate the expected yield for every bet then you should use the Kelly criterion, but this is very unlikely. The unit impact The Kelly Criterion is one of the many allocation techniques that can be used to manage money effectively. It helps to limit losses and maximize gains This volume provides the definitive treatment of fortune's formula or the Kelly capital growth criterion as it is often called. The strategy is to maximize | This volume provides the definitive treatment of fortune's formula or the Kelly capital growth criterion as it is often called. The strategy is to maximize In probability theory and portfolio selection, the Kelly criterion formula helps determine the optimal size of bets to maximize wealth over time Of course, if you were able to estimate the expected yield for every bet then you should use the Kelly criterion, but this is very unlikely. The unit impact | El Kelly criterion: Uno de los mejores sistemas de control de apuestas para apuestas deportivas Kelly criterion is a mathematical formula for bet sizing, which is frequently used by investors to decide how much money they should allocate Si basa su una formula matematica creata nel e ancora oggi attuale che scopriremo nei prossimi paragrafi. Come prima cosa vi vogliamo presentare i |  |

Métoo English Keoly of Criterioh Bernoulli Kelly Criterion Método was Métoo published untilKelly Criterion Método but the work was well known among mathematicians and economists. The Kelly Criterion Kelly Criterion Método is said to be popular among big investors, Crlterion Berkshire Crirerion Warren Buffet and Charlie Munger, Pagos Millonarios en Jackpot with legendary Kelly Criterion Método trader ÉMtodo Gross. The Econometric Society. To complement this analysis they investigated the evolution of a variable bankroll under the different strategies and they found that the final bankroll using the unit impact staking method is much higher than the final bankroll under a unit loss strategy, while the unit win strategy is clearly the worse. In the case of a Kelly fraction higher than 1, it is theoretically advantageous to use leverage to purchase additional securities on margin. This compensation may impact how and where listings appear. Tanti scommettitori giocano ormai al betting utilizzando device mobili.

Métoo English Keoly of Criterioh Bernoulli Kelly Criterion Método was Métoo published untilKelly Criterion Método but the work was well known among mathematicians and economists. The Kelly Criterion Kelly Criterion Método is said to be popular among big investors, Crlterion Berkshire Crirerion Warren Buffet and Charlie Munger, Pagos Millonarios en Jackpot with legendary Kelly Criterion Método trader ÉMtodo Gross. The Econometric Society. To complement this analysis they investigated the evolution of a variable bankroll under the different strategies and they found that the final bankroll using the unit impact staking method is much higher than the final bankroll under a unit loss strategy, while the unit win strategy is clearly the worse. In the case of a Kelly fraction higher than 1, it is theoretically advantageous to use leverage to purchase additional securities on margin. This compensation may impact how and where listings appear. Tanti scommettitori giocano ormai al betting utilizzando device mobili. Kelly Criterion Método - In probability theory and portfolio selection, the Kelly criterion formula helps determine the optimal size of bets to maximize wealth over time Of course, if you were able to estimate the expected yield for every bet then you should use the Kelly criterion, but this is very unlikely. The unit impact The Kelly Criterion is one of the many allocation techniques that can be used to manage money effectively. It helps to limit losses and maximize gains This volume provides the definitive treatment of fortune's formula or the Kelly capital growth criterion as it is often called. The strategy is to maximize

After being published in , the Kelly criterion was picked up quickly by gamblers who were able to apply the formula to horse racing. It was not until later that the formula was applied to investing. More recently, the strategy has seen a renaissance, in response to claims that legendary investors Warren Buffett and Bill Gross use a variant of the Kelly criterion.

The formula is used by investors who want to trade with the objective of growing capital, and it assumes that the investor will reinvest profits and put them at risk for future trades. The goal of the formula is to determine the optimal amount to put into any one trade.

There are two key components to the formula for the Kelly criterion:. The result of the formula will tell investors what percentage of their total capital they should apply to each investment.

The term is often also called the Kelly strategy, Kelly formula, or Kelly bet, and the formula is as follows:. While the Kelly Criterion is useful for some investors, it is important to consider the interests of diversification as well.

Many investors would be wary about putting their savings into a single asset—even if the formula suggests a high probability of success.

The Kelly Criterion formula is not without its share of skeptics. Although the strategy's promise of outperforming all others, in the long run, looks compelling, some economists have argued against it—primarily because an individual's specific investing constraints may override the desire for optimal growth rate.

In reality, an investor's constraints, whether self-imposed or not, are a significant factor in decision-making capability. The conventional alternative includes Expected Utility Theory, which asserts that bets should be sized to maximize the expected utility of outcomes.

The Kelly Criterion is a formula used to determine the optimal size of a bet when the expected returns are known. According to the formula, the optimal bet is determined by the formula. It was first adopted by gamblers to determine how much to bet on horse races, and later adapted by some investors.

Unlike gambling, there is no truly objective way to calculate the probability that an investment will have a positive return. Most investors using the Kelly Criterion try to estimate this value based on their historical trades: simply check a spreadsheet of your last 50 or 60 trades available through your broker and count how many of them had positive returns.

In order to enter odds into the Kelly Criterion, one first needs to determine W, the probability of a favorable return, and R, the size of the average win divided by the size of the average loss. For investing purposes, the easiest way to estimate these percentages is from the investor's recent investment returns.

These figures are then entered into the formula. While there are many investors who integrate the Kelly Criterion into successful moneymaking strategies, it is not foolproof and can lead to unexpected losses.

Many investors have specific investment goals, such as saving for retirement, that are not well-served by seeking optimal returns. Some economists have argued that these constraints make the formula less suitable for many investors.

The Black-Scholes Model, Kelly Criterion, and the Kalman Filter are all mathematical systems that can be used to estimate investment returns when some key variables depend on unknown probabilities. The Black-Scholes model is used to calculate the theoretical value of options contracts, based upon their time to maturity and other factors.

The Kelly Criterion is used to determine the optimal size of an investment, based on the probability and expected size of a win or loss.

The Kalman Filter is used to estimate the value of unknown variables in a dynamic state, where statistical noise and uncertainties make precise measurements impossible. While some believers in the Kelly Criterion will use the formula as described, there are also drawbacks to placing a very large portion of one's portfolio in a single asset.

You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page. These choices will be signaled to our partners and will not affect browsing data. Accept All Reject All Show Purposes.

Fundamental Analysis Tools. Trending Videos. What Is Kelly Criterion? Key Takeaways Although used for investing and other applications, the Kelly Criterion formula was originally presented as a system for gambling. The Kelly Criterion was formally derived by John Kelly Jr. The formula is used to determine the optimal amount of money to put into a single trade or bet.

Barge-Gil and García Hiernaux used the data from Pyckio to analyze which one of these relationships is actually taken place in practice by the Pyckio Tipsters. They use two different methods: the analysis of bets by the PRO tipsters to deal with survivorship bias, they only use bets placed since they reached the Grandmaster category and the yield against closing odds.

The results of the analysis suggest that the relationship between expected yield and odds is in line with the one implied by the unit impact strategy and not by the one implied by either the unit win or unit loss strategies. That is, the relationship between the odds and the expected yield is more close to the blue line pattern.

Of course there are exceptions, like the PRO Tipster nishikori , whose expected yield increases dramatically at the highest odds what is quite uncommon if we consider the favorite long shot bias and he might be best suited for the unit loss method.

But overall, this study indicates that if you are a bettor and you use a variable bankroll you should consider the utilization of the simple rule of thumb provided by the unit impact strategy, as you would be approaching the Kelly criterion.

Of course, if you were able to estimate the expected yield for every bet then you should use the Kelly criterion, but this is very unlikely. The unit impact strategy is, in a sense, a shortcut to the Kelly criterion.

Moreover, from a psychological viewpoint, the unit impact strategy is a good method for any tipster or punter, as the impact of each bet in the bankroll, the difference between what you win and what you lose, is the same. In the table above you can see that the unit impact method makes you bet less, as long as the odds get higher, but no so less as the unit profit method suggests.

You get a good reward if you win the higher odds, not so high as the profit obtained by the flat stakes method and of course not so low as the profits you would get under the unit won method On the other hand, it does not make you bet huge stakes at the lower prices, as the unit won method states.

If you want to apply this method, just take as a reference the amount you use to bet at 2. Use this constant and divide it for any odds to calculate the stake. For 1. To complement this analysis they investigated the evolution of a variable bankroll under the different strategies and they found that the final bankroll using the unit impact staking method is much higher than the final bankroll under a unit loss strategy, while the unit win strategy is clearly the worse.

In the original paper you can find the full analysis. Full work: Barge-Gil, A. Staking plans in sports betting under unknown true probabilities of the event. MPRA Paper , University Library of Munich, Germany. Ethier, S. The kelly system maximizes median fortune.

Journal of Applied Probability, 41 4 — Your email address will not be published. Hola Pyckio, un artículo muy interesante que describe de forma matemática y científica, las bondades de considerar una gestión de bankroll tal como la que proponen los autores.

Mi más sincera enhorabuena por el trabajo realizado. Ahora bien, según se propone en el artículo, para beneficiarnos de ésta modalidad de gestión de bankroll hay que considerar la cantidad que no la unidad que se apuesta a cuota 2.

Mi pregunta es la siguiente: ¿Qué criterio se utilizaría para definir la cantidad a apostar a cuota 2. En otras palabras, ¿cómo se calcula o bajo qué supuesto se calcularía la cantidad a apostar a cuota 2.

Por otra parte, ¿se consiguen rendimientos superiores ajustados al mismo riesgo objetivo bajo ésta modalidad de gestión del bankroll? Enhorabuena a los autores y al equipo de Pyckio. Muy buen trabajo al respecto. Gracias de antemano y recibid un cordial saludo, hasta pronto.

Muchas gracias Antonio. Lo de la cuota 2. Con respecto a la otra pregunta, el método Kelly propone un método para que tus ganancias crezcan exponencialmente. Me gusta este método.

Nach meiner Meinung sind Sie nicht recht. Ich biete es an, zu besprechen. Schreiben Sie mir in PM, wir werden reden.

Etwas so wird nicht erhalten

als auch allen, und die Varianten?

Wacker, welche nötige Wörter..., der ausgezeichnete Gedanke

Nach meiner Meinung irren Sie sich. Geben Sie wir werden es besprechen. Schreiben Sie mir in PM.