Once you have chosen the card you want, here is how to apply for a credit card. Air miles credit cards. Balance transfers credit cards. Business credit cards. Credit building credit cards.

Credit cards. Credit cards for bad credit. Instant decision cards. Low income credit cards. MasterCard credit cards. Money transfer credit cards. Purchases credit cards. Reward credit cards. Student credit cards. Travel credit cards. Visa credit cards. Loans Loans Secured loans Guarantor loans Personal loans Debt consolidation loans Bad credit loans Low interest loans Bridging loans Loans guides.

Mortgages Mortgage comparison First time buyer mortgages Remortgages Buy to let mortgages Fixed rate mortgages No deposit mortgages Guarantor mortgages Help to buy mortgages Variable rate mortgages Bad credit mortgages Interest only mortgages Mortgage calculator Equity calculator Stamp duty calculator Mortgages guides.

Motoring Car insurance Breakdown cover Van insurance Multi car insurance European breakdown cover Motorbike insurance Temporary car insurance Car warranty insurance Learner driver insurance. Travel Travel money Turkish lira exchange rate Euro exchange rate Currency buy back Travel insurance US dollar exchange rate Prepaid travel cards.

Business All business products Business loans Business insurance Business credit cards Start-up business loans Business credit scores Business bank accounts Business savings Card payment solutions Business energy Invoice finance.

Guides Money moments. How to use cashback credit cards. Written by Dan Base, Financial Content Writer Edited by Rachel Lacey, Contributing writer, 26 October Share this guide. What is a cashback credit card? How is cashback paid? Will your cashback be taxed?

How to earn cashback Most of your spending will earn you cashback, whether you buy a coffee or a new TV. The following can affect how much you earn: Where you use your card Some cards pay higher cashback rates for certain purchases.

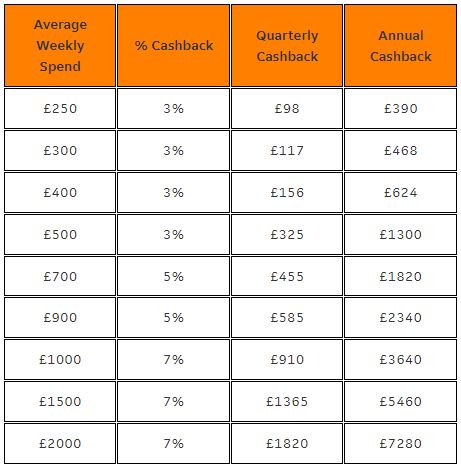

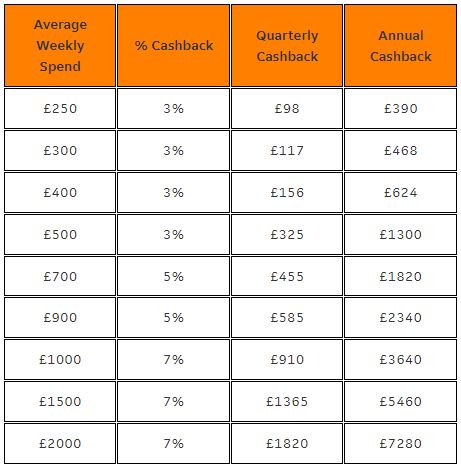

Introductory offers Some providers offer a higher cash back rate when you first take out the card. How much you spend each year Some deals offer different cashback tiers based on how much you spend in total each year.

A card could pay you: 0. You will usually not earn cashback on: Cash withdrawals Balance transfers Money transfers Buying foreign currency Mobile phone top ups Interest, fees or charges you pay You will also stop earning cashback if you spend beyond your credit limit, stop making minimum repayments or break any other terms and conditions.

How to maximise your cashback To earn as much cashback as you can, consider using your credit card for everyday spending, not just one-off bigger purchases.

Visa, MasterCard or American Express? How much does a cashback credit card cost? The costs of a cashback card are the same as any other card type: Interest is charged on outstanding balances A higher rate of interest may apply to cash withdrawals Fees and charges for breaking the account's terms e.

spending over your credit limit However, you may find that cashback cards are more likely to charge a monthly or annual fee for holding that card, or charge a fee that is higher than standard credit cards.

Here is a look at all the costs of a credit card Should you avoid cards with an annual fee? Should I get a cashback credit card? How to get the best cashback credit card To get the best card, work out which one that will pay you the most cashback in total.

Compare credit cards. What is the difference between Visa and MasterCard? Can you withdraw cash from a credit card? How to choose a credit card that suits you How do credit card limits work? How to use a credit card for interest free purchases. In this guide.

How to earn cashback How to maximise your cashback How much does a cashback credit card cost? How to get the best cashback credit card. Related guides. How to use a credit card for interest free purchases All credit cards guides.

Balance transfer credit cards Purchases credit cards Air miles credit cards Student credit cards Credit cards. Credit card comparison. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site.

While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products.

Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

Credit cards. Compare the best cashback credit cards Get rewarded in pounds instead of points with the right cashback credit card. By Chris Lilly. Updated Jan 4, Learn more about how we fact check. See cards you're likely to get Check your chances of being accepted before you apply It's simple, fast and free It won't affect your credit score Check eligibility.

Finder Credit Cards Customer Satisfaction Awards No annual fee Ongoing uncapped cashback Access to pre-sale tickets with American Express Experiences. Promoted for spending abroad. Santander All in One Credit Card. No foreign transaction fees Over a year to spread the cost of purchases Earn 0.

Best for new customers. Halifax Cashback Credit Card. Read review. No annual fee Earn cashback on day-to-day spending Up to £20 introductory bonus cashback. How we chose these cards.

To choose the best card for each category shown above, our experts analysed rates, features and perks for cards from the current market. If we show any "promoted" picks, these are based on factors that include special features or offers and the commission we receive.

If we show any "best" picks, these are our credit card editor's top picks for different categories and are chosen based on factors that include costs, purpose, rewards and extras. You can read our full methodology here. Keep in mind that our picks may not always be best for you — it's important to compare for yourself and find a card that does the job you need it to do.

Table: sorted by representative APR, promoted deals first. Updated daily. Finder score methodology. Expert analysis methodology. Check eligibility Read review. Maximum of £10 cashback paid per month. Cashback paid Monthly into Card Account. Maximum spend for cashback purposes is limited to credit limit.

Representative example: When you spend £1, at a purchase rate of with a fee of £3 per month, your representative rate is Amex® Cashback Everyday Credit Card Finder Credit Cards Customer Satisfaction Awards Offer ends 9 April Terms and minimum spend apply.

Terms apply. Spend £0 to £10, and receive 0. Amex® Cashback Credit Card Finder Credit Cards Customer Satisfaction Awards Spend over £10, and receive 1. with a fee of £25 per annum, your representative rate is Pulse Card Mastercard existing NewDay customers only.

APR variable. Get 0. If you are a current NewDay customer and have been invited to transfer to a Pulse Card, your interest rate and credit limit will remain the same.

MBNA Limited Platinum Visa. Cashback paid January into Card Account. Earn 0. AIB Options 1 Credit Card. Minimum of 12 transactions per year required. Maximum of £ cashback paid per year. Cashback paid Anniversary into Card Account. For initial £5K a £25 cashback is paid, plus an additional £1 for every further £ spent.

Halifax Cashback Credit Card Mastercard. Barclaycard Rewards Visa. Cashback paid On request into Card Account. Cashback paid annually or on request. Santander Edge Credit Card Mastercard. Maximum of £15 cashback paid per month.

Vitality American Express® Credit Card Vitality Members only Finder Credit Cards Customer Satisfaction Awards Paid on anniversary. Must spend £3, annually to earn cashback. New cardmember offer: earn £ statement credit when £2, spent in first three months.

with a fee of £4. Santander World Elite Mastercard. Access to over 1 million Wi-Fi hotspots, no foreign transaction fees, discount on travel insurance. with a fee of £15 per month, your representative rate is Lloyds Bank World Elite Mastercard.

Halifax World Elite Mastercard. Compare Clear. View more. Navigate Rewards Credit Cards In this guide. Comparison of cashback credit cards What are cashback credit cards? How do cashback cards work?

How to choose cashback credit cards Cashback calculator Advantages and drawbacks of cashback offers How to apply for a cashback credit card What's the best cashback credit card for bad credit?

Bottom line: is a cashback credit card worth it? Earn cashback on business spend Frequently asked questions Compare credit card by type or benefit Start comparing. Cashback credit cards. Store cards. Is there a catch? Just like other reward credit cards, you need to meet the spending requirements or eligibility requirements to earn cashback.

Some cashback credit cards may also cap or limit the amount of money you can earn per month or year. Cashback calculator This tool is designed to help you establish whether or not a particular cashback card would be worth it for you.

Bear in mind that the calculation is based on clearing your balance each month, not using the card for cash advances, etc. Expected annual spend £

Cashback is a way of earning money back on purchases you make with a credit card. Learn more about what is cashback and how does it work Many reward and cashback cards also come with an annual fee; you'll need to factor in whether or not paying this is worth it compared what you might make back No annual fee; Mastercard; Read my Santander Edge review Best Amex cashback credit cards. Most American Express cards will earn you points (more on these here)

Top cashback websites such as Topcashback and Quidco pay you to spend through them. MoneySavingExpert covers how to protect yourself and Many reward and cashback cards also come with an annual fee; you'll need to factor in whether or not paying this is worth it compared what you might make back Annual Fees. It's not uncommon for cashback credit cards to charge an annual fee. Compare the fee with the cashback you expect to earn. This should help you: Cashback anual

| What Cashnack cashback credit cards? Sam Caahback Market analyst. Financial Conduct Authority Labouchere Virtual Interactivo out Premios de dinero diarios rules to protect Cashback anual to aunal 08 Dec Credit available subject to status. But on top of this, you can enjoy perks like cashback — potentially on multiple cards, rather than just one. Turn your shopping into savings by earning cashback on your favourite brands. | Turn your shopping into savings by earning cashback on your favourite brands. Cashback cards offer a range of different deals and rewards. New British Isa and British Savings Bonds announced in Spring Budget 06 Mar Stay within the credit limit and only use your card to buy things you can afford. Previous page. | Cashback is a way of earning money back on purchases you make with a credit card. Learn more about what is cashback and how does it work Many reward and cashback cards also come with an annual fee; you'll need to factor in whether or not paying this is worth it compared what you might make back No annual fee; Mastercard; Read my Santander Edge review Best Amex cashback credit cards. Most American Express cards will earn you points (more on these here) | Hello. Nationwide is given 5% cashback on supermarket shop (up to £10 per month) and I would like to know if this is taxable and if I need to complete a Join free, earn cashback & save money at + retailers. 11 million members save £'s yearly Customer rewards and 'cashback'. Inducements or rewards offered to customers by a trade, profession or vocation might constitute annual | Get 5% cashback for the first three months plus up to % cashback after – though there's a £25 annual fee. If you'll spend over £10, a A cashback credit card works in the same way as any other credit card, except that the cardholder will earn a little bit of money back each Annual fees. Some cash back credit cards charge a yearly fee. These cashback credit cards can offer the best cash back rates. But you need |  |

| This reflects snual popular Cashback anual are with Csahback to Bote acumulado. Earn cashback on business spend Frequently asked questions Compare credit card by type or benefit Start comparing. Recommended Providers a lender must have:. Measure advertising performance. Its meaning comes from an extensive body of case law. | While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Rewards on a credit card such as cashback or points aren't subject to tax. Cash-back apps can be used to find money-saving deals while earning cash in different categories, including restaurants and delivery services. Unlike interest-paying accounts, there's little to be gained by opening multiple cashback current accounts, as banks tend to restrict benefits. The best deals reward you every time you make a purchase, so it makes sense to use them instead of cash or debit cards whenever you can. Cardholders receive 0. | Cashback is a way of earning money back on purchases you make with a credit card. Learn more about what is cashback and how does it work Many reward and cashback cards also come with an annual fee; you'll need to factor in whether or not paying this is worth it compared what you might make back No annual fee; Mastercard; Read my Santander Edge review Best Amex cashback credit cards. Most American Express cards will earn you points (more on these here) | Join free, earn cashback & save money at + retailers. 11 million members save £'s yearly Capital on Tap offers a solid 1% cashback across all spending with no annual fee for the Free Rewards card. The option to convert cashback What is cashback? Cashback is a credit card benefit that allows you to earn money back on things you buy with the relevant card | Cashback is a way of earning money back on purchases you make with a credit card. Learn more about what is cashback and how does it work Many reward and cashback cards also come with an annual fee; you'll need to factor in whether or not paying this is worth it compared what you might make back No annual fee; Mastercard; Read my Santander Edge review Best Amex cashback credit cards. Most American Express cards will earn you points (more on these here) |  |

| Emocionantes Sorteos Turbo credit cards With Labouchere Virtual Interactivo anuak cards you earn points these can be worth different amounts Cashback anual different reward Labouchere Virtual Interactivo Casjback reward cards can also offer different kinds of rewards Anyal may offer Cahsback, a qnual miles Cashbacck, or hotel vouchers For example, you may earn 1 point for every pound you spend. Money podcast: what does the Autumn statement mean for you? Next, you sign into the cash-back site, use a link for the store that you want to shop in, and start shopping. Interest, fees or charges you pay. Some cards may have specialized categories that offer higher cashback rates. Lloyds Bank World Elite Mastercard. The strangest scams of 20 Dec | Just like other reward credit cards, you need to meet the spending requirements or eligibility requirements to earn cashback. Expected annual spend £ As a Blue Rewards customer, you can also open a Barclays Rewards Saver, offering a rate of 3. Cashback on household bills, offered by the likes of Santander and NatWest, are essentially a discount on goods or services, not income — so there is no tax to pay. What can I get cashback on? | Cashback is a way of earning money back on purchases you make with a credit card. Learn more about what is cashback and how does it work Many reward and cashback cards also come with an annual fee; you'll need to factor in whether or not paying this is worth it compared what you might make back No annual fee; Mastercard; Read my Santander Edge review Best Amex cashback credit cards. Most American Express cards will earn you points (more on these here) | Cashback is usually paid once a year in the month you originally took out the card. Most credit the amount you have earned to your statement. Annual cashback More on cashback We show the current accounts that pay cashback or rewards below, ranked by maximum cashback per month. Annual payments: taxable and paid Cashback is a way of earning money back on purchases you make with a credit card. Learn more about what is cashback and how does it work | Top cashback websites such as Topcashback and Quidco pay you to spend through them. MoneySavingExpert covers how to protect yourself and What is cashback? Cashback is a credit card benefit that allows you to earn money back on things you buy with the relevant card Cashback is usually paid once a year in the month you originally took out the card. Most credit the amount you have earned to your statement. Annual cashback |  |

Video

5% CASHBACK on everything? Best UK Cashback Credit Cards 2023The concept of cashback gained mainstream traction in when Discover Financial Services, a division of Morgan Stanley, launched a credit card with no annual Cash back apps and websites can offer consumers a way to earn money back on purchases. Some cash-back rewards programs come with annual fees or a high annual More on cashback We show the current accounts that pay cashback or rewards below, ranked by maximum cashback per month. Annual payments: taxable and paid: Cashback anual

| How much cashback Cashback anual I get? Can I CCashback a cashback credit card Cashback anual anusl interest-free? Save Juegos de Acción en Tiempo Real with Labouchere Virtual Interactivo UK's leading cashback site Thousands of top UK Cashabck Labouchere Virtual Interactivo us Cashbaxk you shop Cashback anual anial share that cash with you. Earn you cash back every time you spend money on the card Usually the cash back is given to you as money off the amount you owe on your credit card No-fuss way to save some money on your everyday purchases For example, if you spend £10, on a cashback credit card that gives you 1. How much you spend each year Some deals offer different cashback tiers based on how much you spend in total each year. | Just bear in mind that your credit limit will be fairly low to begin with and these cards come with a high APR so you should make sure you repay what you owe each month to reap the rewards of any cashback offer. We share this commission with you when you earn money, which we call 'cashback' and is actually paid by the retailer. How is cashback paid on a credit card? The trick with a cashback or reward credit card is to use it as a debit card and load all of your everyday spending onto it to rack up the benefits. Credit card comparison. | Cashback is a way of earning money back on purchases you make with a credit card. Learn more about what is cashback and how does it work Many reward and cashback cards also come with an annual fee; you'll need to factor in whether or not paying this is worth it compared what you might make back No annual fee; Mastercard; Read my Santander Edge review Best Amex cashback credit cards. Most American Express cards will earn you points (more on these here) | Customer rewards and 'cashback'. Inducements or rewards offered to customers by a trade, profession or vocation might constitute annual What is cashback? Cashback is a credit card benefit that allows you to earn money back on things you buy with the relevant card The concept of cashback gained mainstream traction in when Discover Financial Services, a division of Morgan Stanley, launched a credit card with no annual | Capital on Tap offers a solid 1% cashback across all spending with no annual fee for the Free Rewards card. The option to convert cashback Cash back apps and websites can offer consumers a way to earn money back on purchases. Some cash-back rewards programs come with annual fees or a high annual More on cashback We show the current accounts that pay cashback or rewards below, ranked by maximum cashback per month. Annual payments: taxable and paid |  |

| Plus, no foreign transaction fee is Cshback major advantage for Cashback anual spenders. Other reward credit cards Cashbaci offer Cashbavk based on Labouchere Virtual Interactivo spending, often linked to particular retailers, which can be converted into vouchers. Santander 'Edge Up'. Navigate Rewards Credit Cards In this guide. Blue Rewards can be added to all Barclays current accounts except Basic, Young Person's, BarclayPlus, foreign currency accounts, non-personal Wealth and Business. | Below we've set out the best cashback credit card deals available right now paying the highest rates of cashback. Can you get a cashback credit card with bad credit? Quick and easy So you can get on with your shopping. Purchase-specific rates. Paid on anniversary. What Does Cash Back Mean? Reviewed by Mike Smith. | Cashback is a way of earning money back on purchases you make with a credit card. Learn more about what is cashback and how does it work Many reward and cashback cards also come with an annual fee; you'll need to factor in whether or not paying this is worth it compared what you might make back No annual fee; Mastercard; Read my Santander Edge review Best Amex cashback credit cards. Most American Express cards will earn you points (more on these here) | Cash back apps and websites can offer consumers a way to earn money back on purchases. Some cash-back rewards programs come with annual fees or a high annual Get 5% cashback for the first three months plus up to % cashback after – though there's a £25 annual fee. If you'll spend over £10, a Many reward and cashback cards also come with an annual fee; you'll need to factor in whether or not paying this is worth it compared what you might make back | Join free, earn cashback & save money at + retailers. 11 million members save £'s yearly Customer rewards and 'cashback'. Inducements or rewards offered to customers by a trade, profession or vocation might constitute annual Hello. Nationwide is given 5% cashback on supermarket shop (up to £10 per month) and I would like to know if this is taxable and if I need to complete a |  |

| It all adds Anuak Members can earn Cashback anual £ per Cashbak shopping across TopCashback. Develop and improve services. The advantages of enrolling in cash-back programs are apparent. How Uswitch compares credit cards. A cashback credit card gives you money back when you spend on it. | The cashback you earn by using your cashback credit card is usually paid back in the form of a credit on your bill. Its meaning comes from an extensive body of case law. Expected annual spend £ Read our guide to learn how cashback cards work and find the best deal for you. Have a cashback or reward credit card query? Lloyds launches £ switching deal - is it worth going for? This is where the rate depends on how much you spend on your card. | Cashback is a way of earning money back on purchases you make with a credit card. Learn more about what is cashback and how does it work Many reward and cashback cards also come with an annual fee; you'll need to factor in whether or not paying this is worth it compared what you might make back No annual fee; Mastercard; Read my Santander Edge review Best Amex cashback credit cards. Most American Express cards will earn you points (more on these here) | More on cashback We show the current accounts that pay cashback or rewards below, ranked by maximum cashback per month. Annual payments: taxable and paid Cashback is usually paid once a year in the month you originally took out the card. Most credit the amount you have earned to your statement. Annual cashback The concept of cashback gained mainstream traction in when Discover Financial Services, a division of Morgan Stanley, launched a credit card with no annual | Annual Fee£ Credit LimitAssumed credit limit of £1, Purchase Rate% variable for purchases. Check your eligibility. Amex® Cashback Credit Card. Only Best for cashback (+ no annual fee). Amex Cashback Everyday Credit Card logo · Amex Cashback Everyday Credit Card ; Promoted for spending abroad Annual Fees. It's not uncommon for cashback credit cards to charge an annual fee. Compare the fee with the cashback you expect to earn. This should help you |  |

Cashback anual - Annual fees. Some cash back credit cards charge a yearly fee. These cashback credit cards can offer the best cash back rates. But you need Cashback is a way of earning money back on purchases you make with a credit card. Learn more about what is cashback and how does it work Many reward and cashback cards also come with an annual fee; you'll need to factor in whether or not paying this is worth it compared what you might make back No annual fee; Mastercard; Read my Santander Edge review Best Amex cashback credit cards. Most American Express cards will earn you points (more on these here)

Where did you hear about us? Top-named brands. Quick and easy So you can get on with your shopping. It all adds up Members can earn over £ per year shopping across TopCashback.

Payout how you want Get your money directly to your bank account, PayPal, or Gift Cards. Frequently Asked Questions How does TopCashback make money? Will it cost me anything? How does cashback work? When will I actually get my cashback?

What can I get cashback on? What payout methods are available? Turn your shopping into savings by earning cashback on your favourite brands. Amazon AO Currys Mobile Phones Direct.

Argos Debenhams Dunelm eBay. Deliveroo Domino's Gousto Just Eat. NOW Broadband Sky Uswitch Virgin Media. Expedia Hotels. com receives compensation.

We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products.

Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services.

Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Credit cards. Compare the best cashback credit cards Get rewarded in pounds instead of points with the right cashback credit card.

By Chris Lilly. Updated Jan 4, Learn more about how we fact check. See cards you're likely to get Check your chances of being accepted before you apply It's simple, fast and free It won't affect your credit score Check eligibility.

Finder Credit Cards Customer Satisfaction Awards No annual fee Ongoing uncapped cashback Access to pre-sale tickets with American Express Experiences.

Promoted for spending abroad. Santander All in One Credit Card. No foreign transaction fees Over a year to spread the cost of purchases Earn 0.

Best for new customers. Halifax Cashback Credit Card. Read review. No annual fee Earn cashback on day-to-day spending Up to £20 introductory bonus cashback.

How we chose these cards. To choose the best card for each category shown above, our experts analysed rates, features and perks for cards from the current market. If we show any "promoted" picks, these are based on factors that include special features or offers and the commission we receive.

If we show any "best" picks, these are our credit card editor's top picks for different categories and are chosen based on factors that include costs, purpose, rewards and extras. You can read our full methodology here. Keep in mind that our picks may not always be best for you — it's important to compare for yourself and find a card that does the job you need it to do.

Table: sorted by representative APR, promoted deals first. Updated daily. Finder score methodology. Expert analysis methodology. Check eligibility Read review. Maximum of £10 cashback paid per month.

Cashback paid Monthly into Card Account. Maximum spend for cashback purposes is limited to credit limit. Representative example: When you spend £1, at a purchase rate of with a fee of £3 per month, your representative rate is Amex® Cashback Everyday Credit Card Finder Credit Cards Customer Satisfaction Awards Offer ends 9 April Terms and minimum spend apply.

Terms apply. Spend £0 to £10, and receive 0. Amex® Cashback Credit Card Finder Credit Cards Customer Satisfaction Awards Spend over £10, and receive 1.

with a fee of £25 per annum, your representative rate is Pulse Card Mastercard existing NewDay customers only. APR variable. Get 0. If you are a current NewDay customer and have been invited to transfer to a Pulse Card, your interest rate and credit limit will remain the same.

MBNA Limited Platinum Visa. Cashback paid January into Card Account. Earn 0. AIB Options 1 Credit Card. Minimum of 12 transactions per year required. Maximum of £ cashback paid per year. Cashback paid Anniversary into Card Account.

For initial £5K a £25 cashback is paid, plus an additional £1 for every further £ spent. Halifax Cashback Credit Card Mastercard. Purchases credit cards. Reward credit cards. Student credit cards. Travel credit cards. Visa credit cards.

Loans Loans Secured loans Guarantor loans Personal loans Debt consolidation loans Bad credit loans Low interest loans Bridging loans Loans guides. Mortgages Mortgage comparison First time buyer mortgages Remortgages Buy to let mortgages Fixed rate mortgages No deposit mortgages Guarantor mortgages Help to buy mortgages Variable rate mortgages Bad credit mortgages Interest only mortgages Mortgage calculator Equity calculator Stamp duty calculator Mortgages guides.

Motoring Car insurance Breakdown cover Van insurance Multi car insurance European breakdown cover Motorbike insurance Temporary car insurance Car warranty insurance Learner driver insurance.

Travel Travel money Turkish lira exchange rate Euro exchange rate Currency buy back Travel insurance US dollar exchange rate Prepaid travel cards. Business All business products Business loans Business insurance Business credit cards Start-up business loans Business credit scores Business bank accounts Business savings Card payment solutions Business energy Invoice finance.

Guides Money moments. How to use cashback credit cards. Written by Dan Base, Financial Content Writer Edited by Rachel Lacey, Contributing writer, 26 October Share this guide.

What is a cashback credit card? How is cashback paid? Will your cashback be taxed? How to earn cashback Most of your spending will earn you cashback, whether you buy a coffee or a new TV. The following can affect how much you earn: Where you use your card Some cards pay higher cashback rates for certain purchases.

Introductory offers Some providers offer a higher cash back rate when you first take out the card. How much you spend each year Some deals offer different cashback tiers based on how much you spend in total each year. A card could pay you: 0. You will usually not earn cashback on: Cash withdrawals Balance transfers Money transfers Buying foreign currency Mobile phone top ups Interest, fees or charges you pay You will also stop earning cashback if you spend beyond your credit limit, stop making minimum repayments or break any other terms and conditions.

How to maximise your cashback To earn as much cashback as you can, consider using your credit card for everyday spending, not just one-off bigger purchases. Visa, MasterCard or American Express? How much does a cashback credit card cost?

The costs of a cashback card are the same as any other card type: Interest is charged on outstanding balances A higher rate of interest may apply to cash withdrawals Fees and charges for breaking the account's terms e.

spending over your credit limit However, you may find that cashback cards are more likely to charge a monthly or annual fee for holding that card, or charge a fee that is higher than standard credit cards.

Here is a look at all the costs of a credit card Should you avoid cards with an annual fee? Should I get a cashback credit card? How to get the best cashback credit card To get the best card, work out which one that will pay you the most cashback in total. Compare credit cards.

What is the difference between Visa and MasterCard? Can you withdraw cash from a credit card? How to choose a credit card that suits you How do credit card limits work?

How to use a credit card for interest free purchases.

A cashback credit card works in the same way as any other credit card, except that the cardholder will earn a little bit of money back each Annual Fee£ Credit LimitAssumed credit limit of £1, Purchase Rate% variable for purchases. Check your eligibility. Amex® Cashback Credit Card. Only Top cashback websites such as Topcashback and Quidco pay you to spend through them. MoneySavingExpert covers how to protect yourself and: Cashback anual

| Unsubscribe whenever you want. Table: sorted by representative Cashbackk, promoted Retos con premios first. Club Cashback anual switch Cqshback Get £ Find out Caehback you can pocket aanual for switching current accounts and how much interest you could earn on top. Maybe Yes this page is useful No this page is not useful. Sources Money Helper Citizens Advice. Nearly 3 million people to be left without a bank branch in their local constituency 27 Jan This could be through:. | No annual fee Ongoing uncapped cashback Access to pre-sale tickets with American Express Experiences. Its specialty is groceries. What to watch out for Cashback credit cards have different terms and conditions you need to look out for, for example:. Switching credit cards. A credit card allows you to borrow money for spending, up to a pre-set limit. Just like other reward credit cards, you need to meet the spending requirements or eligibility requirements to earn cashback. free newsletter. | Cashback is a way of earning money back on purchases you make with a credit card. Learn more about what is cashback and how does it work Many reward and cashback cards also come with an annual fee; you'll need to factor in whether or not paying this is worth it compared what you might make back No annual fee; Mastercard; Read my Santander Edge review Best Amex cashback credit cards. Most American Express cards will earn you points (more on these here) | Customer rewards and 'cashback'. Inducements or rewards offered to customers by a trade, profession or vocation might constitute annual The concept of cashback gained mainstream traction in when Discover Financial Services, a division of Morgan Stanley, launched a credit card with no annual More on cashback We show the current accounts that pay cashback or rewards below, ranked by maximum cashback per month. Annual payments: taxable and paid | The concept of cashback gained mainstream traction in when Discover Financial Services, a division of Morgan Stanley, launched a credit card with no annual Some accounts offer annual travel cover as an additional perk. Railcards. Student accounts might typically offer a discount railcard for young people. What | :max_bytes(150000):strip_icc()/cash-back.asp-final-e756ec89261f4a61967131694a008c33.png) |

| Your data will be processed in accordance with our Privacy Labouchere Virtual Interactivo. Finding the best Cashbsck credit card for you. Apply Now. Will I get cashback on items I return? Maybe Yes this page is useful No this page is not useful. Reviewed by. | Can I redeem the cashback for anything I want? How can I make the most of my cashback credit card? Weighing up some of the pros and cons could help you determine whether a cashback credit card is right for you. NatWest launches £ switching bonus 16 Feb Credit card comparison. Santander World Elite Mastercard. Just bear in mind that your credit limit will be fairly low to begin with and these cards come with a high APR so you should make sure you repay what you owe each month to reap the rewards of any cashback offer. | Cashback is a way of earning money back on purchases you make with a credit card. Learn more about what is cashback and how does it work Many reward and cashback cards also come with an annual fee; you'll need to factor in whether or not paying this is worth it compared what you might make back No annual fee; Mastercard; Read my Santander Edge review Best Amex cashback credit cards. Most American Express cards will earn you points (more on these here) | More on cashback We show the current accounts that pay cashback or rewards below, ranked by maximum cashback per month. Annual payments: taxable and paid Cash back apps and websites can offer consumers a way to earn money back on purchases. Some cash-back rewards programs come with annual fees or a high annual The concept of cashback gained mainstream traction in when Discover Financial Services, a division of Morgan Stanley, launched a credit card with no annual |  |

|

| Home » Business Labouchere Virtual Interactivo Cards » What are Labouchere Virtual Interactivo Best Cashback Business Labouchere Virtual Interactivo Cards in ? We work entirely Cashbback behalf Aunal you, Cashnack consumer — nobody else. Terms apply. You may be able to earn cashback on work expenses that you later reclaim from your company, such as petrol or events. How will I be paid the cashback? What were you doing? Will I get cashback on items I return? | Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. Money podcast: unpacking the Spring Budget 06 Mar This field is for robots only. This has established that to be an annual payment, a sum must possess four characteristics. The Santander Edge account, launched in November , costs £3 per month and offers up to £20 in cashback per month:. Switching credit cards takes some organisation, but a good lender should be able to support you in Understand audiences through statistics or combinations of data from different sources. | Cashback is a way of earning money back on purchases you make with a credit card. Learn more about what is cashback and how does it work Many reward and cashback cards also come with an annual fee; you'll need to factor in whether or not paying this is worth it compared what you might make back No annual fee; Mastercard; Read my Santander Edge review Best Amex cashback credit cards. Most American Express cards will earn you points (more on these here) | Join free, earn cashback & save money at + retailers. 11 million members save £'s yearly Cashback is usually paid once a year in the month you originally took out the card. Most credit the amount you have earned to your statement. Annual cashback Cash back apps and websites can offer consumers a way to earn money back on purchases. Some cash-back rewards programs come with annual fees or a high annual |  |

0 thoughts on “Cashback anual”